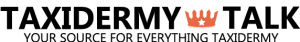

Year-End Bookkeeping for Taxidermy Shops: Keeping It Simple

If you run a taxidermy shop, your “bookkeeping system” is likely a mix of specialized software, carbon copy receipts, and handwritten notes. During the busy season, you do whatever works to keep the shop moving. That’s normal.

The headache usually arrives at year-end when it’s time to hand everything to an accountant. Here’s a straightforward way to wrap up the year without the stress.

1. Know Your Numbers

You don’t need a fancy system; you just need to show where the money came from and where it went. For most shops, this boils down to:

-

Total Income: This includes all the cash, checks, and card payments that came through the door. Whether it was a deposit on a new deer head or the final payment for a finished bird, it all counts toward your year-end total.

-

Payment Streams: Keeping track of how money entered your business (e.g., Stripe, Venmo, or physical checks) makes it much easier to reconcile your bank statements later.

2. The Pre-December 31st Checklist

Before the calendar turns, take care of these basics:

-

Match Your Deposits: Ensure every bank deposit lines up with a specific receipt or invoice. If you deposited $500 in cash, make sure you have the paperwork to back up where that $500 came from.

-

The Inventory Walkthrough: Do a quick count of high-value supplies—forms, tanning chemicals, and glass eyes. Your accountant may need an “Ending Inventory” value for your tax return to calculate your Cost of Goods Sold. (not always needed, talk to your accountant)

3. Simplify Your Expenses (The Pro Tip)

Tracking every single receipt for glue and sandpaper can be a nightmare. Here is a faster way to handle the big stuff:

-

Contact Your Suppliers: Most major taxidermy supply companies and tanneries can provide you with a Year-End Statement or a complete list of invoices with totals. Instead of hunting through your email for twelve different invoices, one phone call or email can get you a single document that covers your entire year of spending with them.

-

The Accordion Folder Method: For the smaller, daily expenses (like gas or hardware store runs), label an accordion folder by month. Drop every physical receipt into the corresponding month as soon as you get it.

-

Pro Tip: Keep your carbon copy receipt books intact. Don’t tear pages out randomly; if an auditor ever asks questions, a chronological book is your best defense.

4. Modernizing Your Shop: Custom Taxidermy Software

If you’re tired of the paper trail, consider moving to custom taxidermy management software. These tools (like MountMonitor, TSS Pro, or Taxidermy Workshop) are built specifically for the workflow of a shop.

-

Track Everything: Follow a mount from intake to the trophy room in one digital file.

-

Financial Sync: Most of these tools track income and expenses in real-time and can sync directly with QuickBooks, making tax time a push-button process.

5. Sales Tax: Don’t Ignore It

Sales tax is the quickest way to get in trouble with the state.

-

Ensure sales tax was charged on every applicable job.

-

Verify that it was filed and paid to the state.

-

Never treat sales tax as shop income—it’s money you are simply holding for the government.

6. Why an Accountant is Worth the Fee

A good accountant who understands small trades can catch deductions you’d miss. To save money on their hourly rate, bring them “clean” info:

-

Bank and credit card statements.

-

Those Year-End Statements from your supply companies.

-

Organized receipt folders (or your software reports).

-

Business mileage logs.

Bottom Line

Most taxidermy shops aren’t messy—they’re just busy. A little organization now prevents a massive headache in April. Get those supplier statements, match your deposits, and lean on a pro for the heavy lifting. Then, get back to the mounting stand.